The Outlook for the Energy Transition Universe in a Higher-Rate Environment

TL;DR

- Interest rates are a major overlooked factor affecting the economics of renewable energy projects. As rates rise, project returns compress.

- However, higher interest rates have also driven up power purchase agreement (PPA) pricing for renewables, boosting project returns.

- Input costs like solar panels and wind turbines are falling, further offsetting the impact of rising rates in 2023.

- By 2024, input cost deflation plus IRA incentives may fully offset higher interest rates. Returns could reach record levels.

- Recent extreme fear has sunk renewable stocks, but historically this leads to outsized upside. Valuations are very attractive.

- Opportunities abound in deeply discounted, interest-rate-sensitive stocks and old-economy companies transitioning to renewables.

- A paired strategy of buying deep value while shorting overvalued names can profit from further rate moves in either direction.

Given recent significant increases in interest rates and subsequent declines in Energy Transition-related equities, we examine the various implications of higher rates on this sector. Our Perspective discusses how interest rate movements have affected Energy Transition markets so far, the positive impacts higher interest rates can have on project economics in this sector, where we are seeking upside, and why we believe now is the time to selectively add long exposure to our portfolio.

The Unexamined Impact of Interest Rates

It is common to see components such as copper, lithium, silicon, glass, steel, solar panels, wind turbines, inverters, and batteries touted – and rightly so – as core materials fueling the Energy Transition, the global shift from fossil-based systems to clean sources of energy. However, we have always recognized another factor as the most critical raw material in this transformation: interest rates.

In both historically low-interest rate environments like 2021 and higher-rate environments like today, interest rates have always and will always affect the Energy Transition. Like all power and infrastructure assets, Energy Transition projects require sizeable upfront funding to capture long-term, contracted cash flows from their output. Whether utility-scale wind and solar, residential solar, geothermal, renewable diesel and natural gas, or hydrogen, these capital-intensive assets are financed upfront with a combination of project debt and tax credit monetization. Given this upfront leverage, interest rates impact project cash flows, the present value of those cash flows, and the amount of debt that projects can support.

In our view, this dynamic factor has been either overlooked or misunderstood by most market participants since we began investing in this universe nearly twenty years ago. Relegated to an afterthought for the past ten years or so, and elevated to a subject of cocktail party chatter in recent months, interest rates and their impact on the Energy Transition deserve a robust discussion, particularly considering the headwinds gusting against equity prices in our universe this year.

The Macroeconomic and Market Landscape

Thanks to rising inflation and the Federal Reserve’s efforts to combat it, combined with worries about soaring fiscal deficits, the yield on the U.S. 10-Year Treasury Bond has dramatically increased – from 1.5% in early 2022 to approximately 4.9% today. We hold no special view on where interest rates top out, but respected macroeconomists are predicting rates approaching 5.5% or higher in the medium term. However, we do believe that the bulk of near-term rate increases are complete following the most aggressive interest rate hiking trajectory in Federal Reserve history.

In the most recent hiking cycle, interest rates and Energy Transition equities have been interacting in what seems to us to be somewhat bizarre and illogical ways.

This noisy chart shows the fickle relationship between the iShares Global Clean Energy ETF (ICLN) and interest rates. Early in the hiking cycle, the ICLN rallied despite interest rate headwinds. It then started to behave as though rates mattered, then reversed course again, largely owing to the passage of the IRA. After a prolonged period of range-bound yields and ICLN performance, interest rates really started pressuring the ICLN in late July 2023.

Over the past several weeks, equity prices within large-scale renewables, utilities, residential solar, and various other interest-rate-sensitive sectors have been ravaged, and this carnage is largely attributable to unabated increases in 10-year U.S. Treasuries – up to 15-year highs. Several bellwether Energy Transition securities have declined by more than 20% since mid-September alone, as investors are liquidating in the face of uncertainty. In our view, the ICLN now clearly indicates that investor confidence has collapsed, with shares down nearly 30% thus far in 2023.

Meanwhile, buy-side and sell-side fear and rhetoric are ratcheting up toward hysteria. As one example, major international investment bank UBS recently hosted a conference call with the foreboding title: “Is it GAME OVER for EU Utes & Clean Tech?”

A more quantitative but no less sensational example is measured by our Energy Transition Greed and Fear index. For many years, we have tracked the ebb and flow of sentiment within our investment universe through our proprietary indicator. Our index comprises put-to-call ratios (higher ratio equals bearishness), put-call skew (higher skew means that investors are paying more for downside than upside), our proprietary short squeeze and crowded short indicator (elevated short and crowded indicators suggest bearishness), price momentum indicators, and realized volatility (higher volatility generally bearish). Combined, these metrics, while not perfect, tend to demonstrate periods of extreme bullishness and bearishness. This measure is currently showing fear levels far worse than during the COVID crisis – in fact, they are at the most dramatic levels we have seen during our 15 years of tracking.

The near-term picture looks as ugly as we can remember in our 20 years of investing in the Energy Transition. So, is it “game over” for the Energy Transition?

On the Other Side of Fear

While we are not naïve enough to ignore these very real challenges, we have experienced several periods of extreme fear throughout our careers – including in 2006 and 2007 – that have involved even higher interest rates than today. From those extreme levels, the ICLN has rebounded with average median one-year, two-year, and three-year forward returns of ~15%, ~20%, and 26%, respectively.

In fact, the last bout of extreme fear – which coincidentally troughed in another October, this one in 2018 – set the stage for greater than 300% returns over the next 24 months. We are not predicting a 300% rally in the Energy Transition universe today, but we do want to stress that extreme returns have historically been built on extreme fear.

From a fundamental perspective, this outlook requires deeper analysis. It is important to understand that while rates have ascended quickly, they are partially mitigated in 2023 and more completely mitigated in 2024 by countervailing factors such as significantly higher realized electricity prices for projects, raw material, and component deflation, and incremental tax credits provided by the Inflation Reduction Act. In fact, not only do we believe that Energy Transition project economics remain intact, but we believe project economics will improve to record levels in 2024 – even if interest rates continue to escalate.

As we will explain below, we require stable interest rates, not necessarily historically low-interest rates, to profit from this chaos.

Implications for Energy Transition Project Economics

All else equal, higher interest rates create significant headwinds for Energy Transition project economics. Our sources show that Energy Transition debt costs have increased from 2.5% to 5% in 2021 and up to 6.5% to 8.5% today.

We estimate that without countervailing factors, this rate increase would crush project economics by more than 80% and render almost all new build projects economically non-viable.

However, interest rates are not rising in a vacuum. Other powerful countervailing forces are helping offset interest rate pressures, including:

- Higher pricing for project outputs

- Lower cost for project inputs

Higher Output Prices = Higher Project Returns

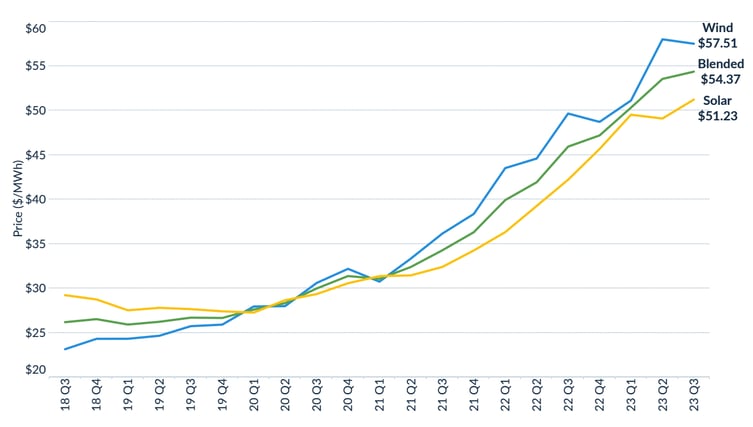

In the historically low-interest rate environment through 2021, renewable project developers bid aggressively on projects, driving down the selling price of renewable electricity to off-takers – and driving down project returns to levels barely acceptable even then. Paradoxically, the higher cost of capital has eliminated these aggressive practices and enabled project returns to increase, setting the stage for superior return profiles on future projects. Renewable projects have achieved much higher pricing since 2021. Power Purchase Agreements (PPA) bids have more than doubled in some cases in roughly equivalent moves to financing costs. The chart below shows the quarterly market clearing prices for wind and solar PPAs as provided by industry leader LevelTen Energy.

Source: LevelTen Energy

We estimate that current higher PPA prices in isolation more than triple the returns on 2021 project economics.

Lower Input Costs = Higher Project Returns

The costs of equipment, components, and raw materials are finally deflating after a period of stout inflation. These declines accrue directly to project returns, serving as offsets to rate headwinds in 2023 and likely more than offsetting rate increases in 2024. We embed conservative cost-deflation assumptions of (4.5%) in 2024, despite recent channel checks showing input cost declines are likely to accelerate even further into 2024. Raw materials like silicon and copper are approaching multi-year-low prices. Solar panels, wind turbines, and power electronics like inverters and batteries are experiencing rapid price declines after several years of stubborn inflation.

Summing It Up

We estimate that these two positive factors can more than offset higher interest rates and lead to project returns that are higher than pre-COVID levels. In addition, incremental tax credits and other cost-of-capital benefits from the Inflation Reduction Act (IRA) will begin to flow in 2024 and beyond. While not underwriting these factors into our models, we believe this upside will likely help shift the negative narrative through the remainder of 2023 as the IRS issues guidance on various outstanding matters throughout the fourth quarter.

As the graph below shows, we estimate that levered project-level returns compressed ~150 basis points between 2021 and today, largely due to higher rates partially offset by higher PPA pricing. We note that 2023 returns still include project cost inflation, which is reversing quickly into 2024.

As interest rates remain high or increase from here, PPA pricing is likely to remain intact or even increase slightly. Moreover, project costs will almost certainly decrease in 2024. We conservatively forecast project debt rates increasing another 100 basis points in 2024. Incorporating these puts and takes, we estimate that project returns will nearly double in 2024 from 2023 and 2021 levels.

Finding the Upside

We have made our case that we believe the Energy Transition project economics remain intact and may provide a path to attractive returns in the future. But what about current market conditions for the sector? As detailed earlier, recent market movements have created a very challenging environment. Given such a hideous backdrop, should we just short long-term rates and Energy Transition equities, then take a long vacation? It may sound appealing, but we think investors are missing one of the most robust investment opportunity sets in years – if not decades.

We have discussed the tailwinds from the Inflation Reduction Act (IRA) and RePowerEU, as well as various other beneficial policies that we believe will start to impact sector fundamentals as early as the fourth quarter of 2023 (i.e., now). Our view on these policies remains largely unchanged aside from the snail-like pace of rollouts. Near-term, however, these policies seem unlikely to catalyze a sustainable rally.

As one example, consider residential solar leader Sunnova Energy International (NOVA). On September 28, 2023, NOVA received a $3 billion loan guarantee from the Department of Energy as part of the IRA. For context, NOVA carried just a ~$1 billion market cap before this news, and this new loan program will reduce NOVA’s cost of financing residential solar systems by 300 basis points. Into this transformative announcement, NOVA had already declined ~55% from its 2023 highs and 25% in September alone. We figured this loan guarantee would at least catalyze a short-term rally, given the incessant selling into month-end. Instead, NOVA proceeded to collapse another ~23% as rate-sensitive equities continued their slide.

We believe the medium-term set-up for this solar firm looks as strong as we can remember, with an improving cost of capital, market share gains, and industry-leading growth in 2024 and beyond. Our base case valuation sits ~75% above the current share price, but we may have to wait patiently as the impact from this loan program flows through to reported results in early 2024.

In our view, the investment landscape is overflowing with more upside opportunities than we can remember in recent history. We remind readers that the Energy Transition universe comprises more than just solar and wind projects. The resilient project economics outlined above support our bullish long-term outlook, but the opportunity set is diversified across a broad set of verticals.

One interesting example is the Engineering, Construction, and Procurement (EPC) firms that are building out the solar, wind, hydrogen, carbon capture, and nuclear projects that provide nearly a decade of backlog visibility at margins far superior to historic levels. We look forward to providing more details in future communications, but the recent drawdown in the universe has created asymmetric opportunities in EPCs that we want to keep under wraps for now.

Also worth considering are some of the most downtrodden interest-rate-sensitive equities with the most compelling valuation support. For example, Atlantica Yield (AY) has been pummeled from $30 to nearly $16 in the recent sell-off. AY is exploring strategic alternatives, including a potential sale of the company or a substantial share repurchase program. With a greater than 10% dividend yield supported by a 15% free cash flow yield, 8x EBITDA multiple (versus recent M&A transactions at 10x to 12x), and more than 90% of its debt fixed or swapped at favorable rates, we believe equity downside is limited from current levels, and forward returns are skewed heavily to the upside. Our no-growth dividend-discount model and no-growth discounted cash flow valuations suggest upside of 30% in a punitive low-case scenario.

Finally, we are discovering opportunities in sleepy old industrial businesses that are transforming into profitable Energy Transition businesses. As one example, there is a nearly 100-year-old, profitable school bus original equipment manufacturer (OEM). On the surface, this company resembles many domestic “melting ice cube” businesses, as diesel school buses are being systematically removed from the school bus operating fleet. However, under the surface, this company has become the largest domestic electric bus OEM.

Most critically and unlike almost all its electric vehicle peers aside from Tesla, this OEM generates profits and cash flow from its electric school bus business. In fact, this business owns a larger share of the electric school bus market than Tesla controls in passenger vehicles. And given that the IRA and prior infrastructure bills subsidize more than the entire cost of electric school buses, school districts are incentivized to add electric buses to their fleets at effectively no cost versus expending precious budget dollars for diesel, natural gas, or propane-fueled buses. As this company is trading at 6-7x near-term EBITDA, with a ~10% free cash flow yield, expanding profit margins due to raw material deflation, growing top-line nearly 40% in 2023, and growing EBITDA even faster, we believe its equity value could more than double in the next 12 to 36 months, irrespective of economic conditions or interest rates.

Conclusion

Should every Energy Transition investor have exited interest-rate-sensitive longs and added more aggressively to interest-rate-sensitive shorts early this summer? In hindsight, of course. However, until July 31, Energy Transition equities were behaving erratically compared to long-term rates, and while the macroeconomics of the short were apparent, the capital markets mostly ignored interest rate impacts on renewables.

Now the question shifts to whether we should remain defensive, given the rapid interest rate moves and equity price reactions. We think the answer relies on valuation. There remain several interest-rate-sensitive names still trading at steep premiums, and there are equities priced for much higher yields. We think current conditions merit a paired equity strategy, with long positions in deeply discounted interest-rate-sensitive equities balanced against short positions in peers trading at steep premiums. If rates fall or stabilize, we believe the longs will bounce far more sharply than the shorts, and if rates continue to rise, we believe far more downside exists in the shorts given their premium valuations.

We are not facing this storm naively, and we appreciate that the interest rate environment can remain a headwind – or a perceived headwind – for far longer than even the most patient investor expects. However, we have lived through far too many extreme selloffs in renewables to press our shorts now. It is time to selectively add long exposure to the portfolio, particularly into some of these battered, deep-value names. We need to ask ourselves – is the next 50% up or down? We think the answer is a resounding “up,” but with heavy volatility along the way. Are there risks? Yes. However, at current equity prices, valuations, gutted investor expectations, and secular tailwinds, we feel the probabilities heavily skew in our favor.

As Howard Marks, the legendary founder of Oaktree Capital Management, wrote far better than I ever could:

“In good times, skepticism means recognizing the things that are too good to be true; that’s something everyone knows. But in bad times, it requires sensing when things are too bad to be true. People have a hard time doing that.

The things that terrify other people will probably terrify you too, but to be successful, an investor has to be a stalwart. After all, most of the time the world doesn’t end, and if you invest when everyone else thinks it will, you’re apt to get some bargains.”

Disclosures: This report is provided for informational purposes and does not constitute an offer or a solicitation to buy, hold, or sell any partnership interests in Satori funds or in any other security. Offers are made only pursuant to a definitive Private Placement Memorandum (“PPM”) and subscription documents for the Satori funds, which contain detailed information concerning the investment terms and the risks, fees and expenses associated with an investment in those funds. Securities of Satori funds are not registered with any regulatory authority, are offered pursuant to exemptions from such registration, and are subject to significant restrictions. In the case of any inconsistency between the descriptions or terms in this document and the PPM, the PPM shall control.

About the Author

Paul Strigler is chief investment officer of Satori Environmental, a long/short equity strategy that primarily invests in securities impacted by the global energy sector’s shift from fossil-based systems to renewable sources. Paul leverages his deep sector expertise, rigorous financial modeling, and robust network to identify catalysts and evaluate opportunities within a proprietary investment universe designed to capture the sector’s most important megatrends. Prior to joining Satori, Paul spent nearly 18 years at a Boston-based hedge fund manager, where he began investing in renewables in 2004 and helped launch the longest-tenured renewables-dedicated hedge fund in the world in June 2009. Over his 12-year tenure, that fund delivered strong, industry-leading absolute returns and significantly outperformed sector benchmarks. Previously, Paul was a strategy consultant at L.E.K. Consulting and held analyst roles at Credit Suisse First Boston and J.P. Morgan. Paul earned his B.A. in economics, with honors, from the University of Chicago and a general course degree in economics from the London School of Economics and Political Science.

The views expressed above are not necessarily the views of Thalēs Trading Solutions or any of its affiliates (collectively, “Thalēs”). The information presented above is only for informational and educational purposes and is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. Additionally, the above information is not intended to provide and should not be relied upon for investment, accounting, legal or tax advice. Thalēs makes no representations, express or implied, regarding the accuracy or completeness of this information, and the reader accepts all risks in relying on the above information for any purpose whatsoever.