Are you of the mind that Operational Due Diligence (“ODD”) is static, boring, and downright dull? You are not alone! But, we have some fresh perspectives on ODD to present below that we hope you will find interesting and thought-provoking.

The purpose of this note is to provide a brief overview of how ODD has evolved since the financial crisis and the primary factors that contributed to its evolution since that time. To close, we are going to highlight four guideposts which we believe will constitute the future of how ODD programs will be constructed, executed, and consumed by investors. Hint: We think consulting will be on equal or greater footing with ODD reports as the primary delivery method of ODD intelligence (as opposed to research reports alone), but more to come on those points, and a few other novel concepts.

Introduction

Since the latest financial crisis, the importance of ODD within the investment allocation decision of institutional investors to alternative investment funds has increased significantly. In plain English, the likelihood of any investor today, regardless of their level of sophistication, albeit it a high-net-worth individual or a large pension plan, investing in any alternative investment fund without completing some type of ODD is nearly unheard of. The impact of this remarkable shift has affected many of the players that are typically involved in the investment process, including investors, placement agents, and investment managers. The impact on investors has often increased the time and cost of their due diligence process relative to before the most recent financial crisis. Placement agents have wanted to gain a higher level of comfort with the operational risk of the managers they may be engaged to market. Investment managers must spend more time on the ODD process with their respective investors as may their service providers, which are frequently contacted by ODD professionals during their reviews. Why has so much changed in the ODD process in such a relatively short period of time, relative to the process that previously existed in the multi-decade history of investments in alternatives?

The Rationale for Historical Shift in the Importance of Operational Due Diligence

We believe that five factors are largely responsible for the increased focus on ODD:

- Hedge Fund Frauds (e.g., Madoff)

- Counterparty Failures (e.g., Lehman Brothers, MF Global)

- Operational Risk Lapses at Global Banking Institutions

- The Growth of the Global Regulatory Regime

- Cybersecurity

Hedge Fund Frauds

Investors experienced hedge fund frauds on an unprecedented level around the time of the financial crisis and in the years that have followed. Types of fraud have included mismarking assets to increase management and performance fee revenues, use of material non-public information to gain a performance edge, and outright theft of investor capital. Fraud has not only been limited to hedge fund structures, but other investment types as well.

Counterparty Failures

Perhaps the most surprising part of the financial crisis was the bankruptcy of major financial counterparties that were previously deemed “safe” and critical to the overall economic health of the U.S., and in some cases, the global economy as well. The effects of these events have led to sharper regulation of financial institutions, a closer monitoring of counterparties, a greater desire to diversify exposure to a given counterparty, and a more selective process with respect to the initial engagement of counterparties.

Operational Risk Lapses at Global Banking Institutions

In the years following the height of the financial crisis, several major financial institutions experienced lapses in their own operational risk controls which led directly to the loss of billions of dollars in capital. These lapses in internal operational risk controls highlighted the fact that operational risks are present at financial firms both large and small. These events brought greater attention to best practices around corporate governance, segregation of duties, and an even broader use of multiple “lines of defense” in a firm’s operational risk mitigation strategy.

The Growth of the Global Regulatory Regime

It’s hard to believe because it’s been so long, but prior to the first quarter of 2012, many alternative investment managers were not registered with the SEC in the U.S. With the passing of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, previously exempt investment advisers were soon required to register with the SEC. In addition, the reporting requirements for investment advisers who were registered increased significantly, so did the associated expenses of maintaining compliance with those regulations. The role of regulatory oversight also increased significantly in countries outside of the U.S. Lastly, the role of Chief Compliance Officer and supporting compliance personnel has become a much more integral and important part of the overall investment management organization.

Cybersecurity

Probably the “hottest” topic in the ODD landscape today. Corporations both within and outside of the financial services sector have been maligned by hackers seeking to hold information for ransom, steal information for identity theft, steal capital via fraudulent wire transfers, and/or steal intellectual property. Investment managers have spent ever larger amounts of their management fees on cybersecurity-related tools to circumvent these nefarious attempts. Investors and regulators as well have placed a larger focus on the need to mitigate cybersecurity weaknesses within organizations. Because this is an evolving threat, where new and more sophisticated methods are used over time, solutions continue to evolve. Probably the best analogy to describe the evolution of cybersecurity is how it has transitioned from a largely defensive posture (e.g., firewalls, passwords) to also incorporate offensive postures (e.g., network penetration, network monitoring, employee training).

The Future of Operational Due Diligence

Although the importance of ODD has grown for prudent investors, the delivery of ODD as a service has remained somewhat static. Perhaps with a few exceptions being: a) the scope of what is covered under an ODD review, which as a list has grown dramatically, and b) the appreciation for the need to complete ongoing monitoring of investment managers from an ODD perspective post investment.

We are of the mind that the future of ODD will incorporate four factors that will increasingly shape the execution of the ODD process, the consumption of ODD intelligence, and our understanding of how operational risk is perceived by investors.

Risk-Based Approach

Most allocators don’t have the capacity to continuously monitor all their investments for ODD in an idealistic manner. Therefore, increasingly, investors will embrace a risk-based approach, whereby, they will take steps to help them ascertain at the inception of their investments, the operational risk profile of managers, and place each manager into an operational risk hierarchy. Under this approach, more frequent follow-ups will occur with managers deemed to have the highest operational risk and managers deemed to be of less operational risk will be followed up with either less frequently, less intensely, or pushed back to a later point in the overall ODD monitoring cycle.

Technology

The use of technology will certainly take on a bigger role in the execution of the ODD process. Especially regarding the collection of information for initial due diligence and the ongoing monitoring of investment managers from a due diligence perspective. Through the use of technology, investors will increasingly be able to monitor a larger number of funds and managers, and then continuously adjust each manager’s operational risk score in a dynamic fashion to decide how aggressively to monitor a manager from an operational risk perspective. Ultimately, this information combined with the performance and investment risk will support the decision to make further investments or to redeem from investment managers.

Each Investor Has a Unique Operational Risk Profile

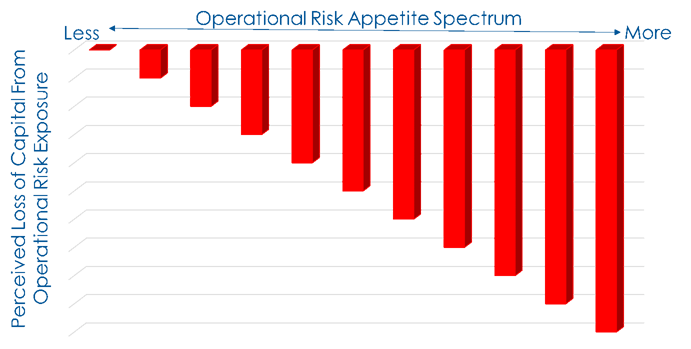

In 1952, Harry M. Markowitz brilliantly elevated our understanding of portfolio management with his essay “Modern Portfolio Theory,” which presumed that every investor seeks to maximize return for a given level of risk. We believe that investors, whether they know it or not, have their own unique operational risk profile. That operational risk profile is essentially driven by the concept that an investor is taking on some level of operational risk with every investment. Different kinds of operational risks will hit different touch points with different investors. Furthermore, investors will decide at the inception of an investment, and through the life of an investment, what level of operational risk (as opposed to portfolio risk) is known and what is acceptable for the type of strategy, expected return, and size of the manager. While some may argue that investors don’t get paid to take operational risk, the truth is that operational risk exists in various forms at managers of all shapes and sizes. The identification and remediation of those risks is the job of ODD. But only the investor or group of investors that makes the investment decision know where they individually or collectively fall on this “operational risk curve”. This operational risk curve supposes that investors weigh certain operational risks differently and that some of them are willing to accept higher operational risks than others under certain circumstances (e.g., where a risk-return profile may be superior to a comparable investment, capacity of the investment opportunity is constrained). Thereby placing each investor on a curve that roughly, although not quantitatively, may look like the graph below.

Co-Sourced Due Diligence

We believe that now and increasingly in the future, the role of ODD will be transformed from one of buying a research report to one that is closer to a true consulting engagement. Whereby an investor engages a consultant to identify operational risks, assess those operational risks in isolation, versus the manager’s peers, and relative to best practices in the industry. And most importantly, to help the investor use the actionable intelligence the consultant develops so that they may achieve a level of operational risk that they will be comfortable with throughout the life of the investment. This isn’t the outsourcing of ODD, where the investor has no active role in the process. This is co-sourced ODD, whereby the investor takes on an active role in the ODD process, but the consultant provides operational leverage, efficiency, additional knowledge about ODD best practices, and operational comparables across the manager universe. We increasingly find the following to be true:

- Investors want to own the ODD process (not outsource it), and they want to contribute their own ideas to that process.

- Investors are seeking external, senior-level expertise, to provide guidance regarding best practices and to provide operating leverage to help them complete what is often a labor-intensive ODD exercise.

- Every investor has a unique “operational risk profile”, which needs to be acknowledged by all participants in the ODD process.

Conclusion

ODD is a dynamic topic, of significant importance to investors. We increasingly find that investors have unique operational risk profiles, have capital and time constraints that require them to leverage external, senior-level expertise to help them build comprehensive ODD programs. Finally, by adopting a co-sourced due diligence approach, investors can leverage the ODD capabilities of highly qualified experts outside of their organizations, at a variable cost, without completely outsourcing or surrendering ownership of a critical part of their overall investment program.

About the Author

Michael Merrigan is the Founder and Managing Member of Shadmoor Advisors, an independent consulting firm established in 2014 which specializes in investment manager operations and operational due diligence risk assessments of investment managers.

The views expressed above are not necessarily the views of Thalēs Trading Solutions or any of its affiliates (collectively, “Thalēs”). The information presented above is only for informational and educational purposes and is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. Additionally, the above information is not intended to provide, and should not be relied upon for investment, accounting, legal or tax advice. Thalēs makes no representations, express or implied, regarding the accuracy or completeness of this information, and the reader accepts all risks in relying on the above information for any purpose whatsoever.