The opportunity for hedge funds, private equity, and other active asset managers to raise capital in the US retail market has never been more attractive. Global wealth has grown to over $200 trillion[1], and the individual investor market has been an increasingly important factor in the growth of asset managers. Financial advisors, including RIAs, Wirehouses, and Broker-Dealers, are playing an increasingly important role as their average assets under management surpass $100 million. While these important trends have been seemingly overshadowed by the incredible rise in passive investing, recent fund flows and product launches suggest that investors are turning again to active management. Although the opportunity is considerable, there are hurdles to overcome for those asset managers entering the retail market. Managers must structure advisor friendly products with consideration for multiple share classes, forge relationships with decision-makers across multiple platforms and optimize related expenses and revenues. With consolidation occurring at the largest financial advisory firms and fragmentation increasing at smaller ones, finding a scalable coverage model is paramount. In this article, we discuss four major trends taking place in the U.S. retail market that are creating opportunities for active managers and the coverage methods we believe will be enhanced by the implementation of a modern and agile sales model:

1) A growing retail space exposes market share waiting to be captured

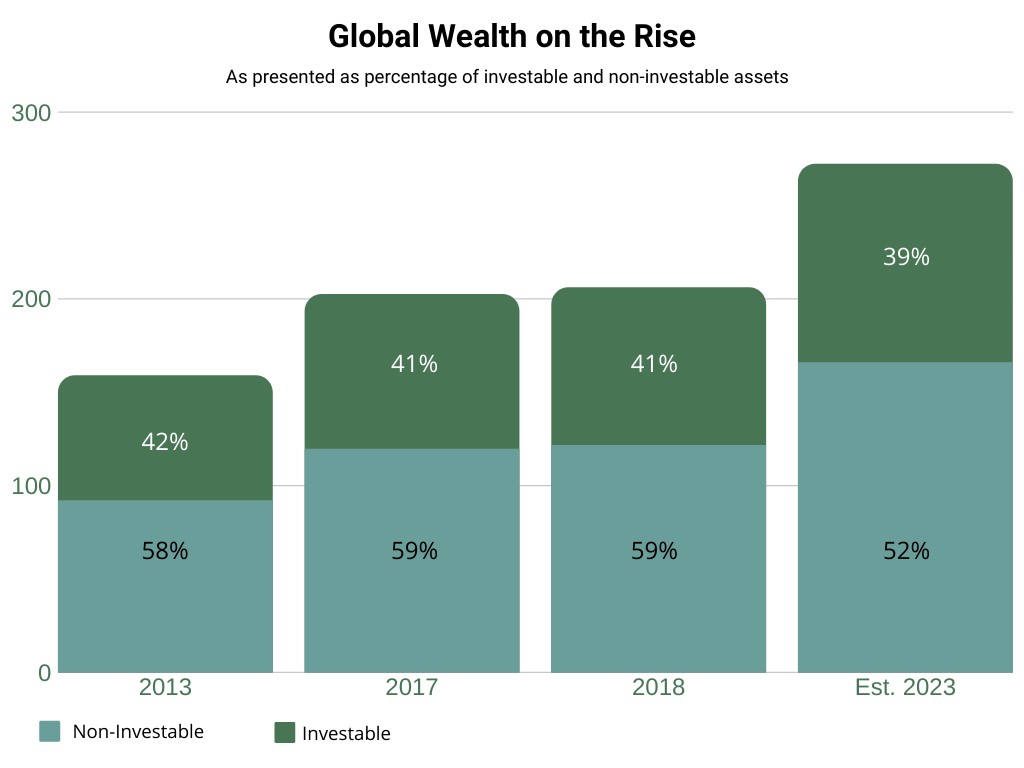

While global wealth estimates vary from multiple studies, the results always recognize an extremely large and growing market. Of the $200 trillion in global wealth assets, $120 trillion is made up of investable assets and we estimate the U.S. retail advisor market is responsible for approximately $60 trillion. Furthermore, these assets under management are widely expected to increase to over $70 trillion in the next 2 – 3 years. There may always be individual investors showing interest in “going it alone” via direct investing or Robo Advisors that prioritize minimizing fees, but financial advisors still control well over $50 trillion of these assets today. If you’re an asset manager looking to capture actively managed market share, focusing on the growing financial advisor channel remains a key opportunity. [2]

[2]

2) Rising AUMs are leading to larger product allocations through financial advisors’ growing books of business

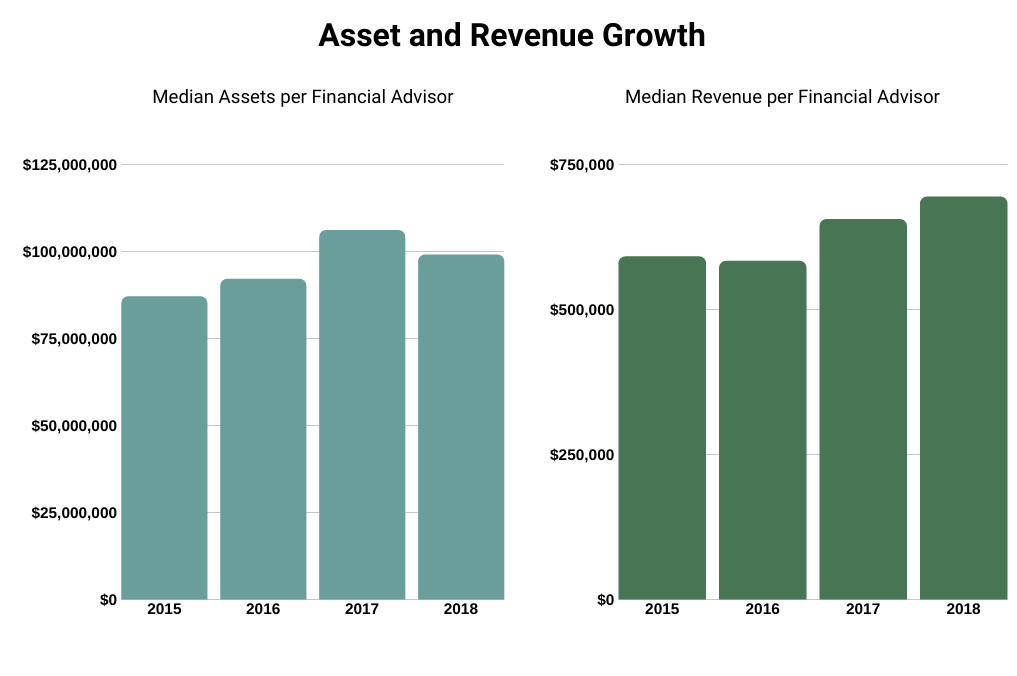

While the number of financial advisors registered in the United States has remained stable over the last decade, their assets have grown significantly. As a result, financial advisors have benefited and the industry has shifted from transaction fees to asset-based fees. This shift has been equally beneficial to individuals as fees for asset-based portfolios have been steadily declining. Consequently, financial advisors have been incentivized to focus on asset growth to maintain earnings which explain the rise in their average AUM. Building relationships with financial advisors can produce larger product allocations for asset managers as products are being allocated across their entire, growing book of business. [3]

[3]

3) Actively managed ETFs and Enhanced Indexes are exposing more investors to actively managed products

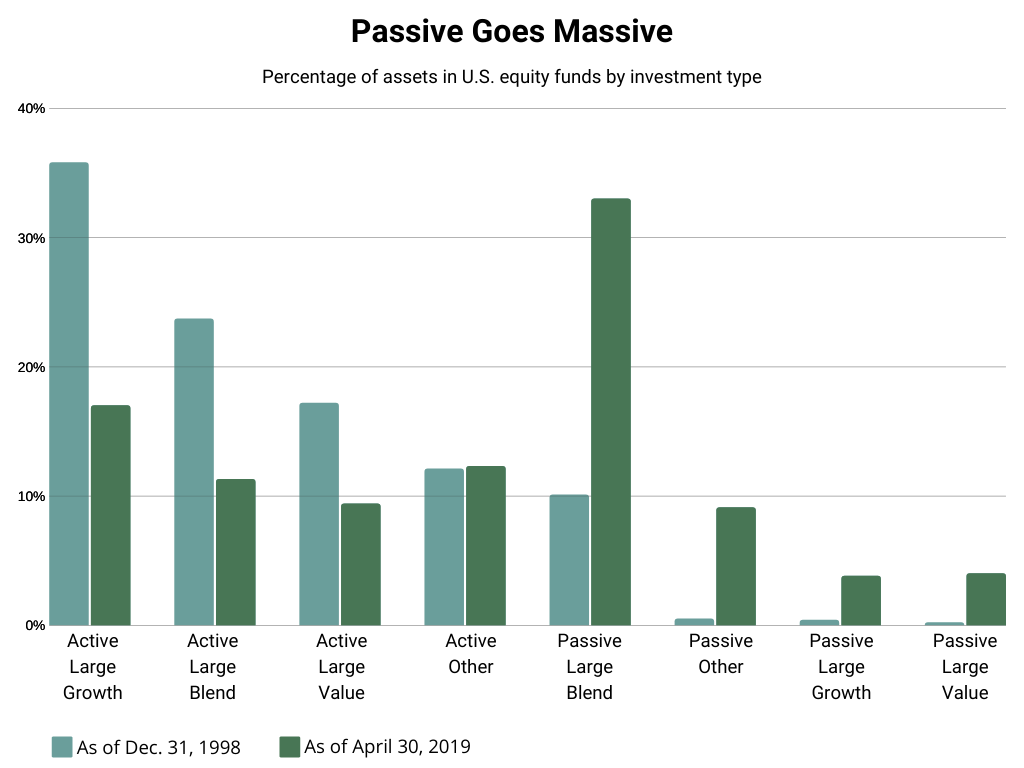

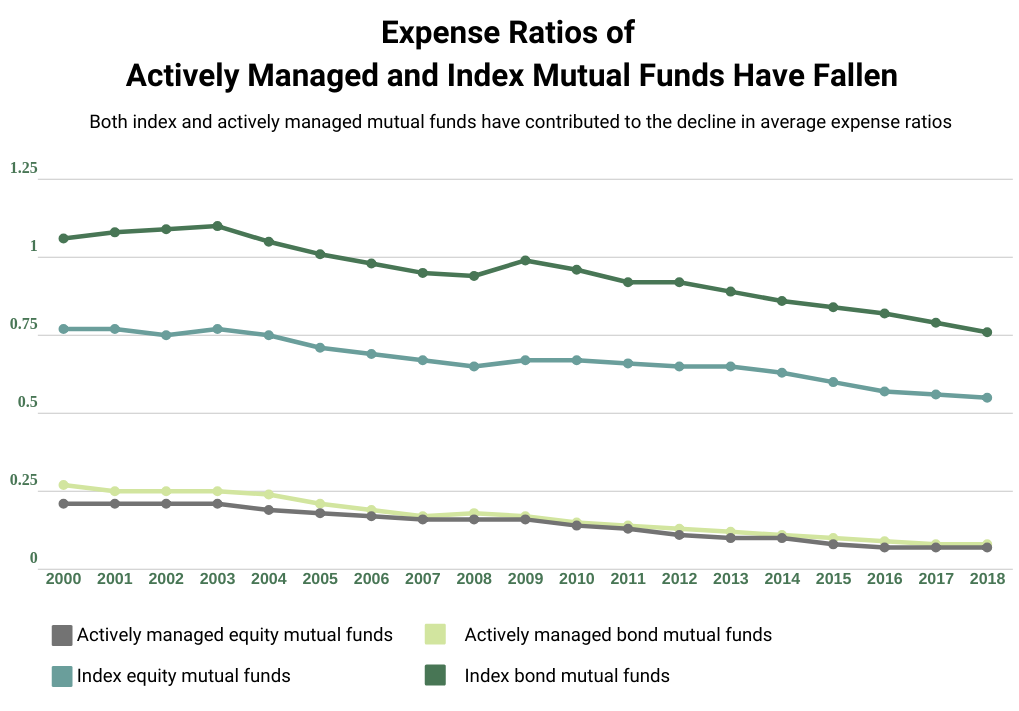

ETFs have continued their extraordinary rise, fueled in part by lower fees, strong markets and the inclusion of these products in fee-based advisory accounts. In fact, ICI and State Street Global Advisors predict that Global ETF assets could grow to $25 trillion in assets by 2025. Conversely, fees of actively managed mutual funds continue to decline and are expected to fall to 45 bps by 2025. Industry margins have followed suit with profits still down 20% from pre-crisis highs. While the growth in ETFs has been mostly at the expense of mutual funds over the last five years, actively managed ETFs are on the rise in multiple themes and investment sectors. This shift from cheaper indexing to what we define as efficient delivery has enabled actively managed products to re-emerge as a growth engine for asset managers. All in all, asset managers will continue to be compensated for performance and innovation while alternative investments (i.e. hedge funds, private equity, real estate), ETFs, models, SMAs and mutual funds will continue to be the main delivery mechanisms into these channels. The “glory days” of pre-crisis management fees are unlikely to return, but quality asset managers will continue to maintain and grow market shares. [4]

[4]

4) Platform consolidations opening doors for new managers and investment strategies

Continued consolidation in both asset and wealth management (140 deals completed in 2018 alone[5]) will continue to put pressure on getting products approved on platforms. Over the last five years, we estimate that the eight largest financial advisor platforms have reduced available funds by more than 5,000. Further consolidation may lead to more declines as the home office gatekeepers rationalize their platforms and reduce the number of products that need to be monitored. However, opportunities to be added to platforms exist for differentiated asset managers as asset allocation strategies become more defined and existing lineups are refreshed. [6]

[6]

Don’t count out active management

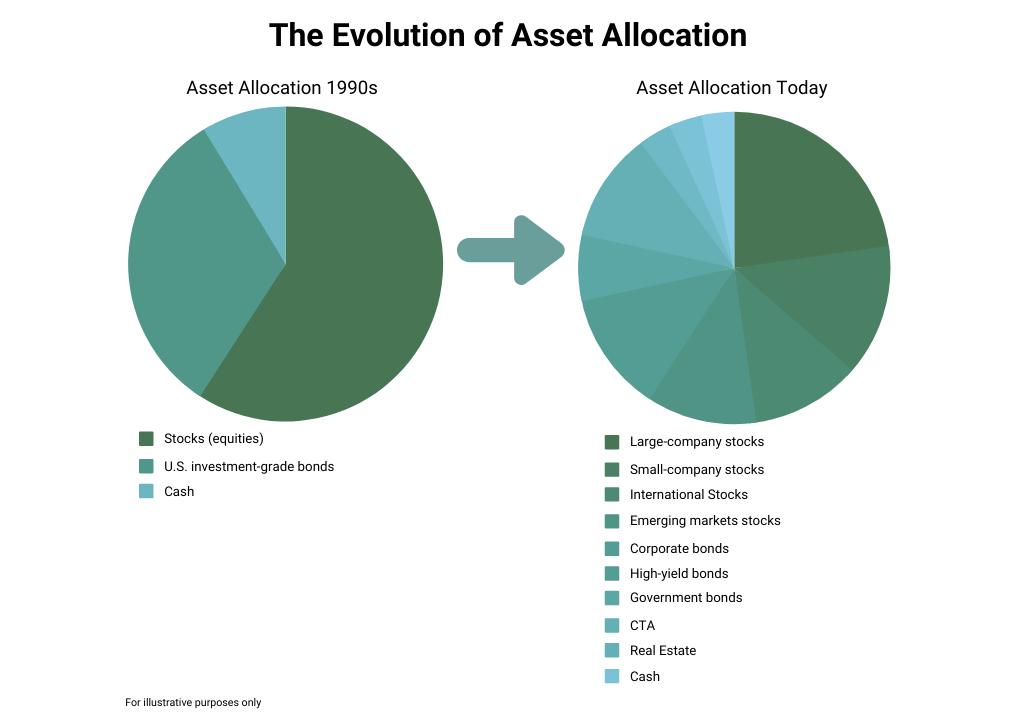

The asset allocation paradigm that was instrumental in shifting brokerage client assets from individual securities to actively managed products in the ’80s and ’90s, with the help from analyst platforms like Morningstar and Lipper, has evolved to include passive portfolios, alternatives, and hybrids in the 2000s.

While not the ideal track for active managers, the reason to remain bullish on actively managed products is two-fold: Traditional asset allocation models continue to adapt and evolve beyond the classic 9 sector style box to now include products like thematic investments, alternatives and hybrid risk-return vehicles like structured notes. Subsequently, to meet client demand as well as to differentiate from the competition, financial advisors must now focus on building diversified portfolios featuring unique investment opportunities that enhance portfolio returns and reduce risk. [7]

[7]

Implementing a scalable coverage model

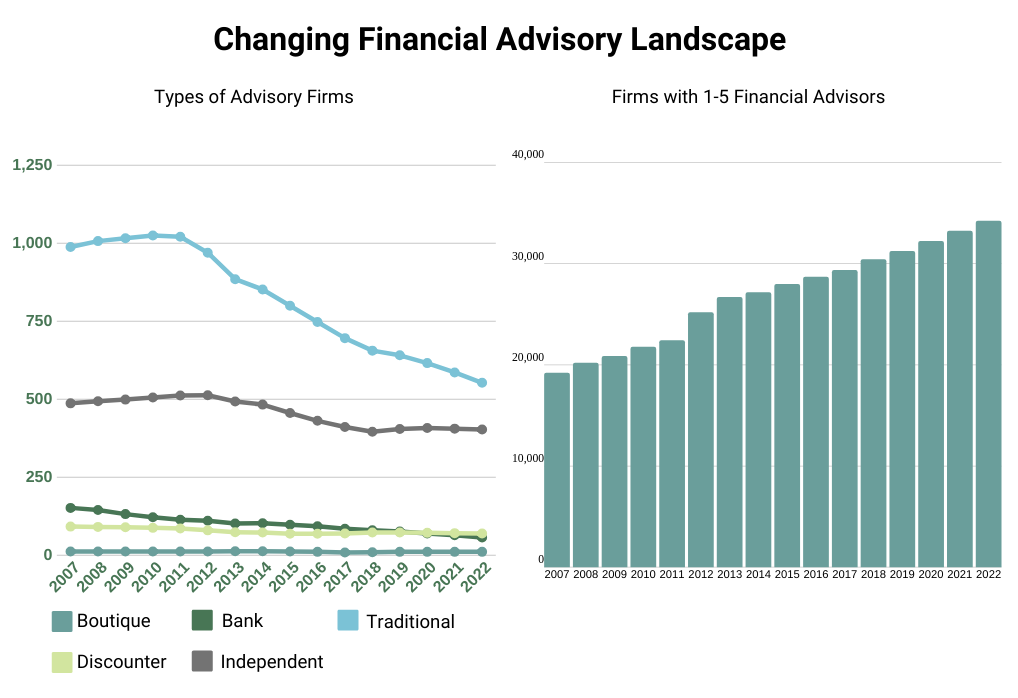

As consolidation of the largest financial advisory firms continues, the most impactful development in the intermediary channel is the continued growth of the RIA segment and the increase in the number of small advisory firms. The number of firms with 10 advisors or less has grown from 21,000 to well over 35,000 in the last 10 years, yet the average assets per financial advisor have grown to over $100 million. Consequently, it has become increasingly difficult, even for the largest asset managers, to efficiently cover the market. Traditional wholesaling models, centered around external salespeople supported by internal resources, are unable to take advantage of the opportunities presenting themselves in the market today. Relationships, scale, and robust data management are instrumental for asset managers looking to efficiently cover and capture true market share. [8]

[8]

Conclusion

Today’s current market presents opportunities for asset managers that are not only substantial but demand a scalable outreach program to cover and capitalize on. As investable assets continue to grow, the actively managed sector will be presented with new opportunities to capture market share. Furthermore, demand for actively managed products will increase from the heightened exposure to actively managed ETFs and enhanced indexes. By building relationships now, asset managers will benefit in the long run as financial advisors continue to grow their AUM. For differentiated asset managers, a consolidation of platforms represents an opportunity for increased exposure as home office gatekeepers refresh their lineups. For these reasons, we believe asset managers must consider implementing a sales process driven by technology to increase their quality and quantity of leads. A technology-augmented wholesaling model that focuses on higher-quality, high-touch engagements and interactions with financial advisors will help asset managers save time and focus on the issues that truly matter.

Sources

[1] Global Wealth 2019: Growth Retreats. Boston Consulting Group (2019)

[2] Global Wealth 2019: Growth Retreats. Boston Consulting Group (2019)

[3] The State of Retail Wealth Management 2018. PriceMetrix (2019)

[4] History Made: U.S. Passive AUM Matches Active For First Time. Institutional Investor (2019)

[5] Sandler O’Neil + Partners (2018)

[6] Trends in the Expenses and Fees of Funds, 2018. ICI (2019)

[7] Schwab Intelligent Portfolio Asset Allocation White Paper. Charles Schwab

[8] Discover Data (2019)

The views expressed above are not necessarily the views of Thalēs Capital Partners LLC or any of its affiliates (collectively, “Thalēs”). The information presented above is only for informational and educational purposes and is not an offer to sell or the solicitation of an offer to buy any securities or other instruments. Additionally, the above information is not intended to provide, and should not be relied upon for investment, accounting, legal or tax advice. Thalēs makes no representations, express or implied, regarding the accuracy or completeness of this information, and the reader accepts all risks in relying on the above information for any purpose whatsoever.